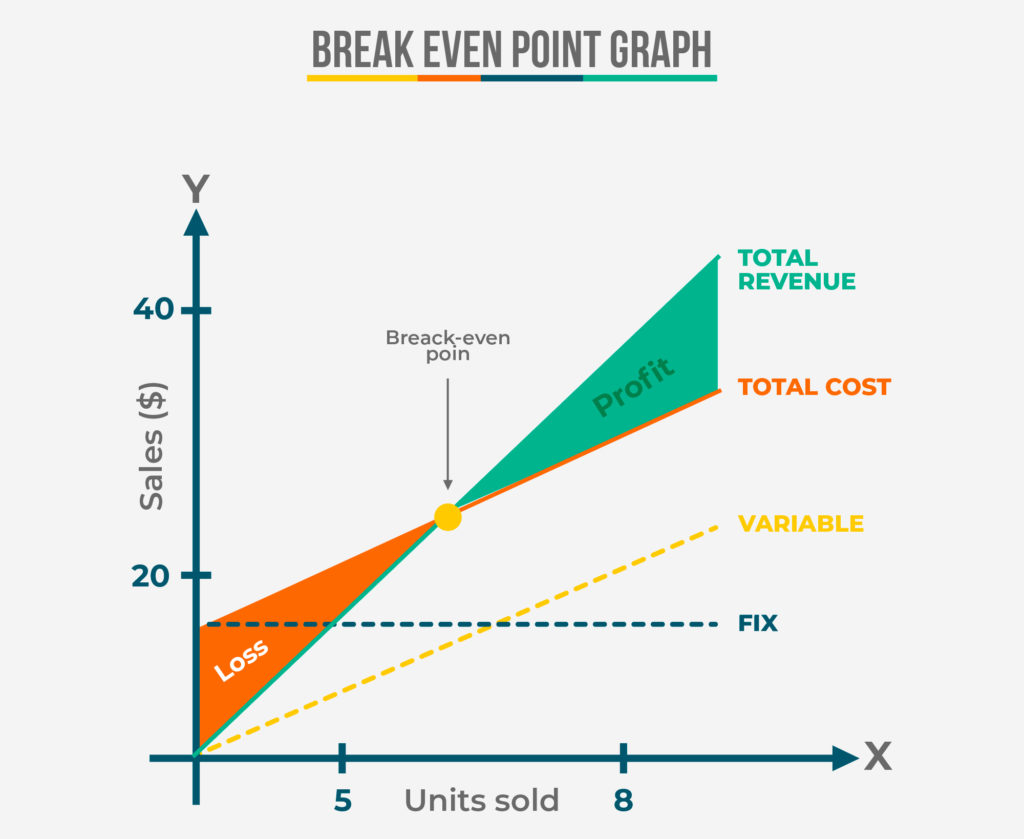

Your business is “breaking even”—not making a profit but not losing money, either.

The break-even point (BEP) is the point when your business’s total revenues equal its total expenses. After the break-even point, any additional sales will generate profits.

When Should You Use a Break-Even Analysis?

The break-even point is one of the most commonly used concepts of financial analysis, and is not only limited to economic use, but can also be used by entrepreneurs, accountants, financial planners, managers and even marketers. Break-even points can be useful to all avenues of a business, as it allows employees to identify required outputs and work towards meeting these.

For a new business, a break-even analysis is a critical part of the financial projections in the business plan because the potential financial backers are mainly interested to see when the business expects to break even so they will know when it will become profitable.

But even if the business doesn’t need outside financial support, it is essential to know when the business is going to break even. This will help to plan the amount of capital is needed and determine how long that capital will need to last.

The purpose of break-even analysis

The main purpose is to determine the minimum output that must be exceeded for a business to profit. The break-even analysis is a rough indicator of the earnings impact of a marketing activity.

A company can analyse ideal output levels to be knowledgeable on the amount of sales and revenue that would meet and surpass the break-even point. If a business doesn’t meet this level, it often becomes difficult to continue operation.

Calculations For Break-Even Analysis

Break-even analysis can also help businesses see where they could re-structure or cut costs for optimum results. Working out the cost of making a product or delivering a service and consequently how much to charge doesn’t seem too complicated.

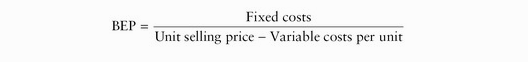

The break-even point is calculated by dividing the total fixed costs of production by the price of a product per individual unit less the variable costs of production. Fixed costs are those which remain the same regardless of how many units are sold.

Real-World Example

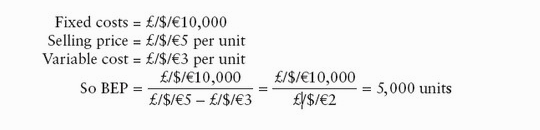

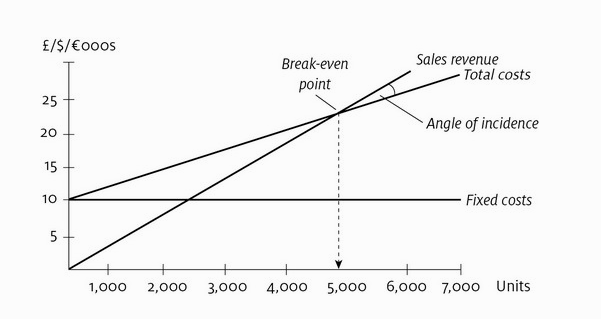

In the above example, it is shown that before you can reach profits the company must pay for the variable costs. This is done by deducting those costs from the unit selling price. What is left (usually called the unit contribution) is available to meet the fixed costs.

Once enough units have been sold to meet these fixed costs, the BEP has been reached. We can see that 5,000 units must be sold at £/$/€5 each before the business can start to make a profit.

Also if 7000 is the maximum output there are only 2000 units available to make the required profit target. Obviously, the more units we have available for sale after the break even point, the better.

The relationship between total sales and the break-even point is called the margin of safety.

Conclusion

The point where the sales revenue line crosses the total costs line is the break-even point (BEP). It is only after that point has been reached that a business can start to make a profit.

Break-even analysis is only one of a number of business tools a firm has in its toolbox and is best used with other tools to ensure that the company has a solid foundation on which to base its decisions.